Here is 1 piece of good news for Ethereum. But is it a good buy?

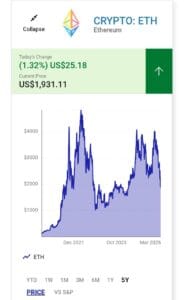

After a 23% price drop in the past three years, Ethereum (ETH 1.34%) holders are looking for signs of improvement. However, is one piece of good news enough to justify buying the coin again? Let’s look at what happened and what it could mean for the future.

It will be easier for certain institutional investors to hold Ethereum.

To keep and trade Ethereum, large financial institutions require significantly more than the average retail investor. On that topic, on March 11, a subsidiary of Germany’s largest stock exchange, the Deutsche Boerse, said that it would begin offering institutional clients the chance to retain both Ethereum and Bitcoin in its custody. The exchange intends to offer other cryptocurrency services, such as stablecoin holding and real-world asset tokenisation, in the near future; consumers will be able to use its Ethereum custody services beginning in April.

This decision indicates that Ethereum, and cryptocurrencies in general, are finally gaining ground in the European Union’s financial industry, which has historically been more hesitant to interact with crypto than its American counterparts.

For holders, this is an absolutely beneficial development. However, there is no guarantee that the investment banks and trading groups that utilise Deutsche Boerse will purchase huge amounts of Ethereum to take use of the exchange’s new features. At the very least, they will now have the technical ability to do so if they so desire.

So it’s realistic to expect some of those clients to purchase some of the coin. Because the Boerse is also launching cryptocurrency transaction settlement at the same time, Ethereum trade volume may increase in the near future. It is also extremely possible that with more cash available to the blockchain, projects in the ecosystem will have a slightly easier time finding funding from institutional investors

There’s no salvation to find here

Nonetheless, this new development is not a compelling incentive to acquire Ethereum, and it is unlikely to reverse or even moderate the chain’s tailspin.

Ethereum has a market capitalisation of $234 billion, and as of March 14, its 24-hour trading volume was close to $13 billion, down 29% from the previous 24-hour period. In January of this year, the German exchange reported a turnover of slightly over $140 billion in cash-settled market transactions of stocks and other assets. Given that Ethereum remains a frontier asset, it is unlikely that it will account for even 1% of Deutsche Boerse cash volume.

There is simply no way that conservative professional investors would begin to flock into such a volatile asset, even if they believed there might be some gain in the future. Furthermore, even if Ethereum did grab that percentage of the volume, it may not be enough to make a significant change in the average level of demand for the coin at any given time.

But the actual reason Ethereum isn’t worth buying right now is because there hasn’t been any significant work in making the chain more competitive with its arch competitor, Solana. There are presently no reported intentions to add Solana to the Deutsche Boerse, which is a tiny consolation for Ethereum holders.

However, this does not affect the fact that Solana is a significantly faster and cheaper chain to use.

If additional E.U.-based exchanges follow the Boerse’s lead, or if Ethereum custody and trading proves to be an unexpected hit with institutional investors in that region, it may be worth reconsidering whether to acquire it. Until then, it is advisable to remain away.

Should you invest $1,000 in Ethereum now?

Before you buy Ethereum shares, consider this.

The Motley Fool Stock Advisor analyst team has picked the top ten stocks for investors to buy now. Ethereum was not one of them. The ten equities that cut might provide massive gains in the next years.

Consider when Netflix published this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $480,061!*

It’s worth mentioning that Stock Advisor’s overall average return is 803%, which is a market-crushing outperformance when compared to the S&P 500’s 160%. Don’t miss out on the most recent top ten list, available when you join Stock Advisor.