Ethereum Isn’t as Important to Investors as Bitcoin

Spot Ethereum ETFs were expected to be a game-changer with their recent introduction. Nevertheless, it appears that investors are more drawn to Bitcoin than Ethereum.

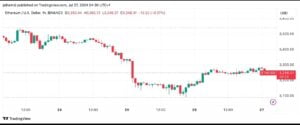

Ethereum’s price dropped from $3,563 to $3,086 during the first week of trading, mirroring the introduction of the Bitcoin spot ETF.

So what caused this to occur? Grayscale’s 2.5% charge on its Ethereum ETF is a major contributing factor. This high cost is turning away investors.

The eight ETFs saw net withdrawals of $178 million in just four days.

Of total, Greyscale alone is accountable for $1.16 billion.

Only 10% of the original ETHE converted to ETH, indicating that net outflows persisted even with a new Mini ETF that offered a lower charge of 0.15%.

Ethereum’s battle to be unique

According to QCP’s most recent analysis, the traditional “buy the hype, sell the news” scenario is another problem.

Before the ETF debut, investors flocked in, expecting a significant rally. However, when that didn’t occur, they liquidated their assets fast.

The primary issue with Ethereum is its abstract nature. Ethereum lacks a catchy slogan that would appeal to people in the traditional finance industry, unlike Bitcoin, which is sometimes referred to as “digital gold.”

New investors find it more difficult to comprehend and become enthusiastic about this. The absence of staking features in these ETFs is another disadvantage. Ethereum’s allure stems in large part from its staking feature, which rewards holders.

Investors would have less motivation to invest without it. Because of this, despite the initial excitement, the spot Ethereum ETFs have received a chilly reception.

Bitcoin takes centre stage.

In the options market, Bitcoin was the star of the show while Ethereum was having trouble. Right now, all the buzz is about Donald Trump’s speech, which made the market tense.

According to QCP, there was a great deal of anticipation since the implied volatility for options expiring on July 28 was 85, nearly twice the realised volatility.

Large funds were betting on a significant rise, with some setting themselves up for a breakout following Trump’s address and the Federal Open Market Committee (FOMC) meeting that was coming up.

“The Trump Card,” a bullish tactic, was selling a 60,000 put and

← Cryptopolitan

purchasing a call fly for 70/72/74k. By August 2, if Bitcoin reaches $72,k, investors may benefit from a year return of 701.9%.

Another negative tactic was “Sell The News,” which sought to make money if the price of Bitcoin dropped to between $65,000 and $63,000. If Bitcoin falls into this area, according to QCP, this strategy would provide a threefold return on the premiums paid.

The enthusiasm was further heightened when Jelle, a cryptocurrency trader, noticed a large expanding wedge that was dropping and building around the previous cycle highs of Bitcoin.

Jelle claims that if Bitcoin surges, its price may jump to $85,000.

As of this writing, the price of Ether was $3,248 and that of Bitcoin was $67,829.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Source : cryptopolitan