Dogecoin pricing under pressure as miners sell off

The recent sell-off in Dogecoin has caused investor concerns and may indicate a decline in market stability.

The meme coin is presently trading around $0.17, with analysts warning that if selling pressure persists, it might fall below $0.15. According to Cryptopolitan, this may boost volatility and lead to further corrections.

Key takeways

Dogecoin faced pressure as miners unloaded 65 million tokens in 48 hours.The token price is now hovering around $0.17, with a potential drop below $0.15 if pressure remains. The problem is exacerbated by Bitcoin’s depreciation, inflationary concerns, and regulatory uncertainty.

Despite the pessimistic prognosis, economists expect that the DOGE could recover if macroeconomic conditions improve.

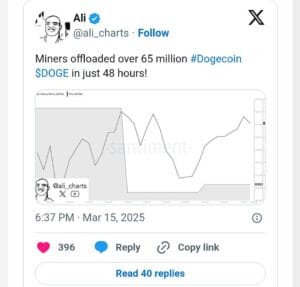

According to crypto expert Ali Martinez, miners unloaded 65 million DOGE in just 48 hours. The number of liquidated tokens implies that miners are reacting not only to market volatility, but also to falling incentives like as reduced block rewards and growing operational costs caused by electricity prices.

The Macroeconomic and market factors

In addition to internal difficulties, the situation is influenced by broader macroeconomic trends. With Bitcoin plunging below $85,000 and inflation fears growing, altcoins such as DOGE are experiencing increased volatility. Historically, Bitcoin price declines have exacerbated swings throughout the crypto market, with meme tokens suffering the most.

Analysts point to various factors for the recent sell-off. In addition to market volatility, central banks’ tighter monetary policies have exacerbated risk aversion among investors. Regulatory uncertainty in the US and Europe also depletes retail, making digital assets less appealing in the short run.

Analyst projections and possible trend reversal

Despite the bearish signals, some experts remain optimistic. Trader Tardigrade believes Dogecoin may be on the verge of a rally. “A HUGE Dogecoin surge is coming,” he wrote, citing historical patterns where growth often follows a correction. Analyst ByllifyX predicts DOGE could rise to $3 if buyer demand strengthens.

Social cues, whale behaviour, and political influence

Other influences include social and political events. Elon Musk’s recent statements regarding the Department of Government Efficiency (DOGE) on The Joe Rogan Experience have reignited retail interest.

Previously, Donald Trump’s announcement of a digital asset reserve project prompted DOGE to soar 20% to $0.24, even though it was not included in the proposed reserve.

DOGE is now trading at $0.1752, up 0.4% over the last 24 hours, with a trading volume of $695.6 million.

While short-term volatility may persist, some analysts believe Dogecoin has long-term potential if macroeconomic trends change and investor confidence recovers.

It’s worth noting that in January 2025, Bitwise Asset Management, a well-known crypto investment firm with over $10 billion in assets, filed filings in Delaware to create a statutory trust for a Dogecoin exchange-traded fund.