Coinbase’s Re-Entry into India’s Cryptocurrency Market: FIU Approval Drives Global Crypto Adoption!

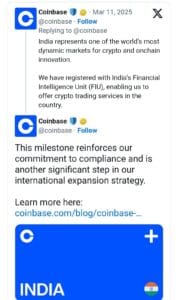

Coinbase Global, a renowned global cryptocurrency exchange, has officially re-registered with India’s Financial Intelligence Unit (FIU), marking a significant step towards re-entering the Indian digital asset market. The re-registration by Coinbase Global is expected to cause significant changes in India’s bitcoin trading ecosystem.

India’s FIU clearance of Coinbase is a watershed moment in the country’s cryptocurrency landscape. As Indian investors’ interest in digital assets grows, the business now legally offers crypto trading services.

India is the world’s leader in cryptocurrency adoption.

Coinbase recognises India as a priority market since it has the highest cryptocurrency adoption rates in the world. According to a Chainalysis analysis published in late 2024, India is the world leader in cryptocurrency adoption, with millions of private investors participating.

Coinbase’s APAC Regional Managing Director, John O’Loghlen, likewise sees India as “one of the most exciting market opportunities in the world.” He told us: “We’re proud to deepen our investment here in full compliance with local regulations.”

Coinbase’s re-entry into the Indian cryptocurrency market

Coinbase’s re-entry into India’s cryptocurrency industry boosts its Asian market position while also furthering crypto legalisation efforts in an emerging region. The company’s return contributes to its strategic goal of entering economies with strong fintech growth. The decision indicates how India’s perspective on digital assets is shifting in response to rigorous regulatory measures and increased investor interest.

Following their regulatory approval, Coinbase plans to introduce retail trading services in India later this year and will subsequently roll out investment products that promise to transform the country’s crypto landscape.

RBI Restrictions and Tax Regulations in India

International cryptocurrency exchanges have expressed severe concerns about India’s regulatory environment. The Reserve Bank of India (RBI) historically restricted foreign cryptocurrency exchanges, even banning major market players like Binance and KuCoin. Coinbase’s attempt to enter the Indian market was likewise halted by the RBI two years ago.

Furthermore, India has one of the highest cryptocurrency transaction tax rates, with a 30% tax on trading gains and a 1% Tax Deducted at Source (TDS) on each trade. As a result, tax rules in India have driven some investors to use peer-to-peer (P2P) platforms and decentralized exchanges.

The Way Forward: Coinbase’s Strategic Vision

Coinbase’s adherence to Indian regulations reflects its conviction in the market’s future potential, even as it navigates taxation hurdles and policy concerns. Coinbase’s registration indicates a regulatory change that might lead other international exchanges to pursue similar registrations. The present developments may result in a more inclusive regulatory environment that promotes innovation and attracts investment.

Coinbase’s re-entry into India’s cryptocurrency market will likely heighten the competitive landscape. Domestic exchanges, such as CoinDCX, WazirX, and ZebPay, as well as international exchanges Binance and KuCoin, must adapt to quickly changing market conditions.

The presence of a globally recognised and regulated corporation in the market, such as Coinbase, can drive up security standards while also promoting transparency and industry innovation. This event may push Indian officials to reevaluate existing cryptocurrency and tax policies in order to strike a balance between safeguarding investors and fostering market growth.

What’s next? A New Chapter for Crypto Adoption in India.

Coinbase’s re-entry into India’s market signals a shift in the country’s regulatory approach to cryptocurrencies. Securing clearance allows the exchange to establish itself as a leader in both compliance standards and industry best practices. Despite ongoing tax difficulties, India’s digital asset market continues to have enormous growth potential.

To succeed with its imminent launch, Coinbase must successfully navigate regulatory difficulties while also garnering consumer trust. Successful implementation of this plan could set a precedent for multinational crypto exchanges joining the Indian market, encouraging a more transparent crypto economy.